Child Care Search Tool

One of the many features of the Strive Employee Life & Family (SELF) program is assistance with locating child care.

Log into my.mchcp.org, select the SELF icon, then click on the link for guidanceresources.com. Follow the instructions to register if you do not have not previously registered your account.

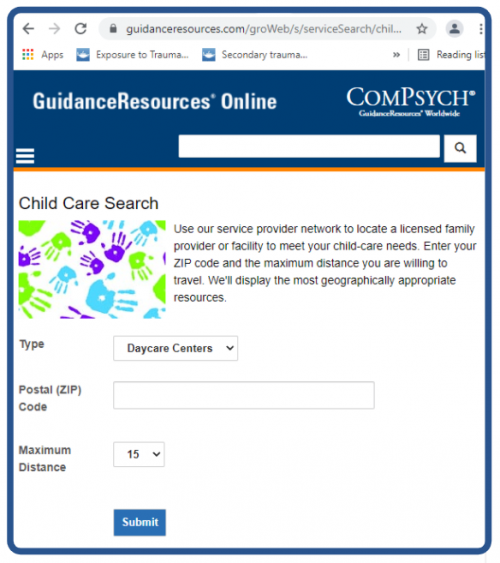

Once you are logged in, hover over “Relationships”, then click on “Child Care.” On the left column, under “I’m looking For,” select "Child Care." Click “Continue” in the pop-up box to fill in the short form and view results. See screenshot to the right. Provider lists are updated in December and June to keep them current.

You can also access the Child Care Search on the GuidanceNow app! Use the same username/password as your guidanceresources.com login.

Dependent Care Flexible Spending Accounts

Dependent Care Flexible Spending Accounts create a tax break for dependent care expenses (typically child care or day care expenses) that enable you to work. Additionally, if you have an older dependent who lives with you at least 8 hours per day and requires someone to come into the house to assist with day-to-day living, you can claim these expenses through your Dependent Care Flexible Spending Account. If you are married, your spouse must be working, looking for work or be a full-time student. If you have a stay-at-home spouse, you should not enroll in the Dependent Care Flexible Spending Account. The IRS allows no more than $5,000 per household ($2,500 if you are married and file a separate tax return) be set-aside in the Dependent Care Flexible Spending Account in a calendar year.

Please note that IRS regulations disallow reimbursement for services that have not yet been provided, so even if you pay in advance for your expenses, you can only claim service periods that have already occurred. For example, if you are required to pay for all of January's child care expenses on January 1st, you cannot claim the entire month's expense until the end of January. However, you may submit a claim every week, at the end of that week, for those expenses.

- Eligible expenses include day care, baby-sitting, and general purpose day camps.

- Ineligible expenses include overnight camps, care provided by a dependent, your spouse or your child under the age of 19 & care provided while you are not at work.

Expenses may only be claimed for dependents that are under the age of 13; or for older dependents that live with you at least 8 hours each day and are incapable of self-care.

Remember that your election is fixed for the entire year unless you have a qualifying event.

For more information, log into your Missouri Cafeteria Plan by logging into your ESS portal, clicking "Benefits" at the top right, and then choosing “Log Me In To Missouri Cafeteria Plan (ASI).”

DHSS Family Partnership program

The Family Partnership strives to enhance the lives of individuals and families impacted by special health care needs, providing resources and information to empower families to live a good life. The Family Partnership hosts regional and statewide events to benefit families through development of leadership skills, networking among peers, and staying current with trends and issues. Special Health Care Needs employs Family Partners, who are parents of individuals with special health care needs and are well equipped to assist in exploring options and solutions for the unique needs of individuals with complex medical conditions.

- Family Partnership Fact Sheet: Family Partnership Fact Sheet final - 8.11.16 (mo.gov)

- Family Partnership Map: Family Partnership Region Map (mo.gov)

DSS Childcare Assistance Programs

The Missouri Department of Social Services provides a financial assistance program to help with the cost of child care. To determine your eligibility, review the guidelines on the DSS website.

MOST 529

Missouri’s 529 education plan is an investment account you can use for education savings. Earnings grow federally tax-deferred, and qualified withdrawals are tax-free. 529 accounts can be used to pay for 2- and 4-year colleges, post-secondary trade and vocational schools, postgraduate programs, and K-12 public, private, and religious institutions (tuition only).

MoABLE

MoABLE is a tax-free savings plan for parents/caregivers of those with disabilities. For more information, visit the MoABLE website.